Council tax slammed as the new ‘POLL TAX’ as levy ‘consuming large share’ of Britons’ incomes

Council tax in the UK is now consuming nearly as much of poor households’ income as income tax, according to new research from the Resolution Foundation.

The think tank’s study reveals the poorest fifth of households spend 4.8 per cent of their gross income on council tax, whilst paying around 5.9 per cent in income tax.

According to the Resolution Foundation, this amounts to just £300 difference annually between the two taxes for Britain’s poorest families.

The findings come from the Foundation’s “Money, Money, Money” report, which examines changes in income sources and expenditure patterns among lower-income households.

While the poorest fifth of households spend 4.8 per cent of their income on council tax, the richest fifth pay just 1.5 per cent, according to the report.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Council tax is making up more of lower income households’ tax burden, experts warn

GETTY

In response to this reach, the Resolution Foundation has slammed council tax as a “hugely aggressive” levy.

The contrast with income tax is striking, where the richest fifth spend more than three times as much of their budgets (21.6 per cent) compared to the poorest households (5.9 per cent).

Between 1994-95 and 2020-21, the financial burden of council tax has grown substantially, with average bills rising by 77 per cent in real terms.

This increase, coupled with reduced support for payment assistance, has hit poor families particularly hard.

Britons are concerned about the growing tax burden

GETTY

The poorest households now spend 4.8 per cent of their income on Council Tax, up significantly from 2.9 per cent in 2002-03.

Furthermore, the Resolution Foundation’s research shows this growing burden has been exacerbated by a decline in social security benefits, which have fallen by 8 per cent in real terms since 2010-11.

Lalitha Try, Economist at the Resolution Foundation, warned of the tax’s growing similarity to its predecessor.

“Council Tax is consuming a larger share of their poor families’ household budgets, who are spending almost as much on these bills as they pay in income tax,” she said.

“This terribly designed tax increasingly resembles the very thing it was meant to replace – the dreaded Poll Tax.”

Try also noted that while the UK economy has stagnated, poor households’ incomes haven’t risen enough in recent decades, despite earnings playing an increasingly important role in their finances.

LATEST DEVELOPMENTS:

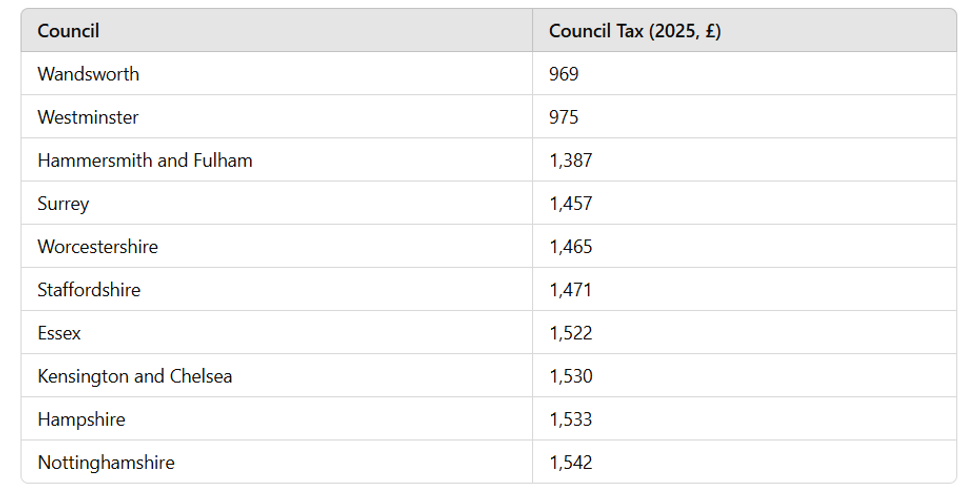

Top ten cheapest council tax rates in England and WalesGBN

Top ten cheapest council tax rates in England and WalesGBNThe financial pressure on Britain’s poorest households looks set to intensify further in the coming year as council tax bills are due to rise by up to 5 per cent across England.

Six councils will be permitted to implement even steeper increases, including Labour-run Bradford, Newham, and Trafford, and Lib Dem-controlled Windsor, Maidenhead and Somerset.

These impending rises threaten to worsen the already disproportionate burden on low-income families, who are spending an ever-greater share of their income on the tax.

Economists have called for reform to the levy as the tax in England and Scotland is charged based on the value of properties in 1991.

#Council #tax #slammed #POLL #TAX #levy #consuming #large #share #Britons #incomes

Source link