‘Great news’ for 629,000 homeowners as mortgage rates set to be cut ‘immediately’ by Bank of England

‘Great news’ for 629,000 homeowners as mortgage rates set to be cut ‘immediately’ by Bank of England

Mortgage holders and Britons looking to get on the property ladder are being told to prepare for “great news” ahead of the Bank of England’s base rate announcement later this afternoon.

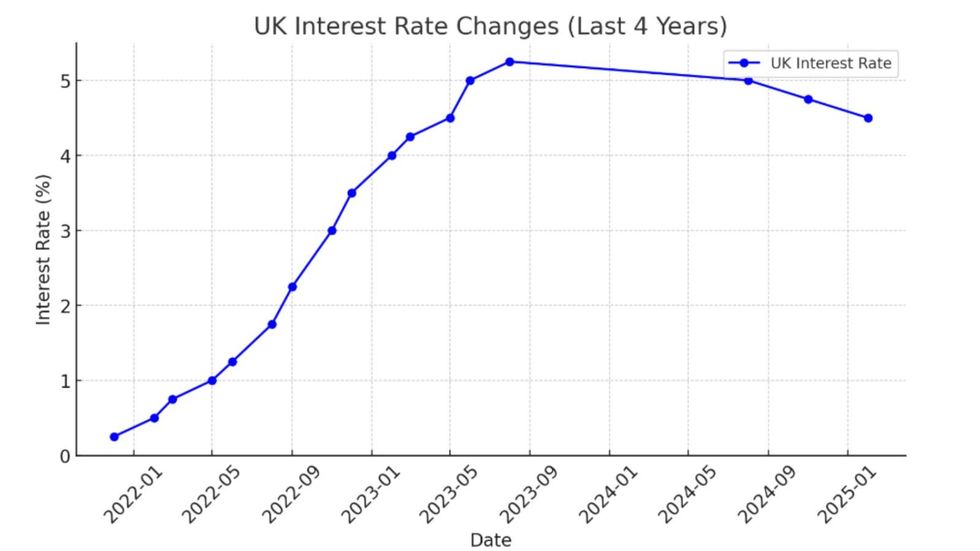

The central bank is expected to cut the UK’s base rate at midday from 4.75 per cent to 4.5 per cent, marking a significant shift in monetary policy aimed at boosting the UK economy.

This likely move from the Bank’s Monetary Policy Committee (MPC) comes as inflation has fallen to 2.5 per cent in the 12 months to December, though still remaining above the financial institution’s target.

Analysts are highlighting this reduction to the base rate, which determines the cost of borrowing, will bring immediate relief to hundreds of thousands of mortgage holders across Britain.

However, economic uncertainties loom, with experts warning US President Donald Trump’s trade policies potentially creating inflationary pressures that could affect UK price rises.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

“Great news” for mortgage holders as the Bank of England is expected to cut the base rate

GETTY

Around 629,000 homeowners with tracker mortgages will see an immediate benefit from the rate cut, with monthly repayments expected to decrease by approximately £29.

A similar number of households on variable rate deals could also see savings, as lenders face pressure to reduce their rates in line with the Bank of England’s decision.

While fixed-rate mortgages won’t see immediate changes, analysts are reminding the public that a rate cut could lead to better deals for new borrowers or those looking to renew their mortgages.

Adrian MacDiarmid, the head of Mortgage Lender Relations at Barratt Redrow, expects high street banks, building societies and lenders to lower mortgage rates following the cut.

Mortgage repayments have shot up for many borrowers in recent years GETTY

Mortgage repayments have shot up for many borrowers in recent years GETTY“This is great news for both existing homeowners and buyers, offering a welcome sense of stability in what has been an unpredictable market,” the mortgage expert explained.

MacDiarmid urged potential buyers to act quickly before stamp duty threshold changes take effect from April 1 and highlighted opportunities for buyers to access competitive rates.

Specifically, he noted that schemes like Own New Rate Reducer enable buyers to secure rates from as low as 1.66 per cent, “significantly reducing their monthly payments in the early years of the mortgage.”

Terry Higgins, the group managing director of TNHG New Build Mortgages, explains that lower Bank rates typically translate to reduced borrowing costs across the board.

Higgins shared: “For UK homeowners who are on a variable or tracker-rate mortgage, these cuts could lead to lower monthly repayments.”

He highlighted that the changes could make property ownership more accessible for future buyers, who might be able to borrow more due to improved affordability.

LATEST DEVELOPMENTS:

Interest rates have skyrocketed in recent years due to the Bank of England’s decison-making CHATGPT

Interest rates have skyrocketed in recent years due to the Bank of England’s decison-making CHATGPTHiggins advised those approaching remortgage to monitor rate forecasts carefully, as further cuts could emerge throughout the year. “By switching to a mortgage with a lower interest rate, homeowners can reduce their monthly payments further or shorten the term of their loan,” he added.

Ahead of today”s announcement, analysts have shared their prediction that the central bank will slash the base rate multiple times in 2025 to ease the financial pressure on borrowers.

However, the Bank of England’s Governor Andrew Bailey has indicated a cautious approach to future rate adjustments and has not committed to a set timeline for pending cuts.

Speaking in December, when rates were held at 4.75 per cent Bailey emphasised the Bank would take a “gradual approach to future interest rate cuts.”

#Great #news #homeowners #mortgage #rates #set #cut #immediately #Bank #England

Source link